Key takeaways from “The Psychology of Money” by Morgan Housel

The Psychology of Money by Morgan Housel is a book that explores the psychological and emotional factors that drive financial decision-making. It examines how our experiences, values, and beliefs shape our relationship with money and how this relationship can affect our financial well-being. The book provides insights and stories to illustrate the key points it covers.

Some of the key takeaways from the book include:

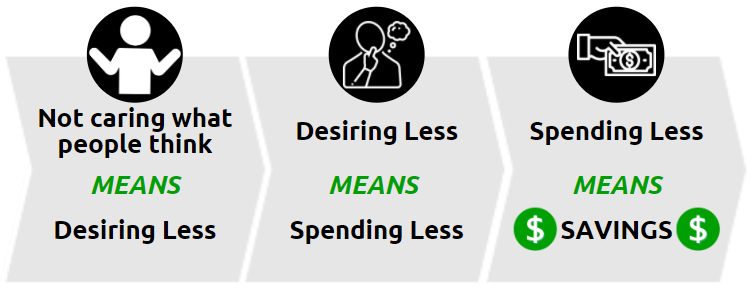

- Understand the difference between wants and needs: In The Psychology of Money, Morgan Housel argues that too often, people confuse the two and end up spending money on things they don’t truly need, which can lead to financial stress and regrets. He encourages readers to be mindful of their spending and to prioritize their needs over their wants.

- Perspective is key: Housel notes that people often focus too much on the short-term and fail to see the bigger picture. He stresses the importance of having a long-term perspective when it comes to money and to be able to step back and see the forest for the trees, so to speak.

- Luck plays a significant role in financial success: Many people attribute their financial success to their hard work and smart decisions, but luck plays a significant role. This serves as a reminder that success is never certain and that we should always be prepared for the unexpected.

- Money can be a source of freedom: Housel argues that money should be used as a tool to gain freedom, rather than a source of stress. He encourages readers to focus on saving and investing their money in order to gain financial freedom.

- Have a plan for your money: Housel notes that people who have a plan for their money are more likely to be successful than those who don’t. He encourages readers to set financial goals and develop a plan to achieve them, through budgeting, saving, investing and financial education.

Overall, The Psychology of Money offers valuable insights into the psychological and emotional aspects of financial decision making, and how understanding and managing these can help us gain greater control over our finances and achieve financial freedom.